Introduction

While doing our scouting and mapping processes, we gather various news, updates, events, opportunities and many other topics of interest related to the startup ecosystem.

Part of the Startup Ecosystem Radar, we prepare this information in a digestible form and deliver it to our partners and clients on a weekly basis, with the aim to inform them about the ecosystem and help them make business decisions.

Despite the uncertain times, the Romanian tech startups area is growing as expected, a fact that is underlined also by the total capital attracted by these startups this year.

Based on the public announcements, in the first 6 months of 2021, 60 rounds of investment were made in Romanian startups and a few in foreign startups which have Romanian founders but living abroad.

The total investment volume for this period was roughly €82.2M in 50 rounds in startups based in the country or with most of the employees in Romania (even if the company is incorporated elsewhere) and ~€878.4M in foreign startups with Romanian founders (10 rounds), counted separately.

When it comes to the type of the investments, as the visualisation shows, there were mostly deals worth between €200K – €1M (28), followed by investment rounds with less than €200K (12) and deals situated between €1M and €3M (9). Most of the deals were happening in connection with Bucharest-based startups while only 10 of them were in Cluj, Iași or Timișoara.

Moreover, we have to note that this year there was also FintechOS’s Series B funding round, and the 10 deals attracted by the foreign startups with a Romanian founder were much larger than the domestic Romanian startups.

Also, before the IPO UiPath has completed a Series F financing round. It has drawn $750M from investors such as Alkeon Capital and Coatue, as well as Altimeter Capital, Dragoneer, IVP, Sequoia, and Tiger Global (link).

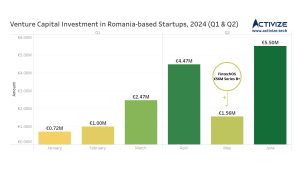

Venture capital funding for Romania-based startups

Through January to June 2021, the startups based in Romania have attracted ~€82.2M in 50 deals, divided by the following way:

- €1.5M in 12 rounds up to €200K

- €14.1M in 28 rounds €200K to €1M

- €16.4M in 9 rounds €1M to €3M

- $60M in FintechOS

Some of the highest and most important investments were the following:

- FintechOS, the global technology provider for banks, insurers and other financial services companies, has raised $60M in Series B funding. The round was led by Draper Esprit (link).

- The crowdfunding platform SeedBlink ended a Series A financing round worth €3M, of which €1.1M was funded through its own crowdfunding platform, double its initial target. This investment campaign was the largest financing carried out through the platform SeedBlink (link).

- Druid, a startup specialized in developing intelligent virtual assistants (chatbots) for Enterprise organizations, has raised $2.5M through a Series A financing round led by GapMinder VC with an investment of $2.2M, and completed by Early Game Ventures and private investors (link).

- Questo, a platform for city exploration games, has attracted funding worth $1.5M in an investment round led by Early Game Ventures with Sparking Capital‘s participation (link).

- Bunnyshell, which specializes in developing technologies for cloud infrastructure management, raised €1.1M in a round of investment led by local investment fund Early Game Ventures (link).

In order to have access to the full list of investments, join Startup Ecosystem Radar.

Funding for foreign startups with Romanian founders

For the first part of 2021 was nice to see startups with at least one Romanian co-founder living abroad raised a total of ~€242.8M in venture capital:

The most important investments were the following:

- The American company Databricks, which has two Romanian IT specialists among its founders, obtained a financing of $1B, with the participation of Google Ventures, Amazon, and Microsoft (link).

- Capsida Biotherapeutics Inc., a US biotechnology startup, has received $140M financing from two venture capital firms and pharmaceutical group AbbVie. The startup’s solution is based on the research conducted at Caltech by Romanian professor Viviana Gradinaru (link).

- Chili Piper, a SaaS appointment scheduling platform for sales teams, has raised a $33M Series B round led by Tiger Global (link).

In order to have access in real time to this kind of information, join Startup Ecosystem Radar.

Conclusion

Knowing that we are still living in an uncertain period because of the COVID-19 pandemic, the first thought about investments would be that for surely venture capital fundraising took a hit, but looking at the numbers and statistics we find out that there is a sustained activity in this area, people have accommodated themselves to the situation and they started going back to their pre-pandemic ways of doing business.

If we look back at the last two years in terms of investments done in Romania-based tech startups, we see an ascending trend: where in 2019 we tracked 70 funding deals reaching in total €40M and in the first 6 months of 2020 approximately 30 deals totalising ~€20M, in 2021’s first half we noted 50 deals worth €82.2M, including FintechOS’s $60M round.

The angel investment trend continued. From angel networks like Techangels, Growceanu or Transylvania Angels Network or through Seedblink or from other angel investors, startups were able to raise checks of €200K and even up to €400K (of course with a decent €20-30K MRR and aligned valuation for angels’s appetite of €3-5M), which in the past was rarely happening.

This shows that if the flow remains the same as it is now, at the end of this year we could present you a three-digit number and officially say that 2021 was the Romanian tech startups’ best year in terms of fundraising.