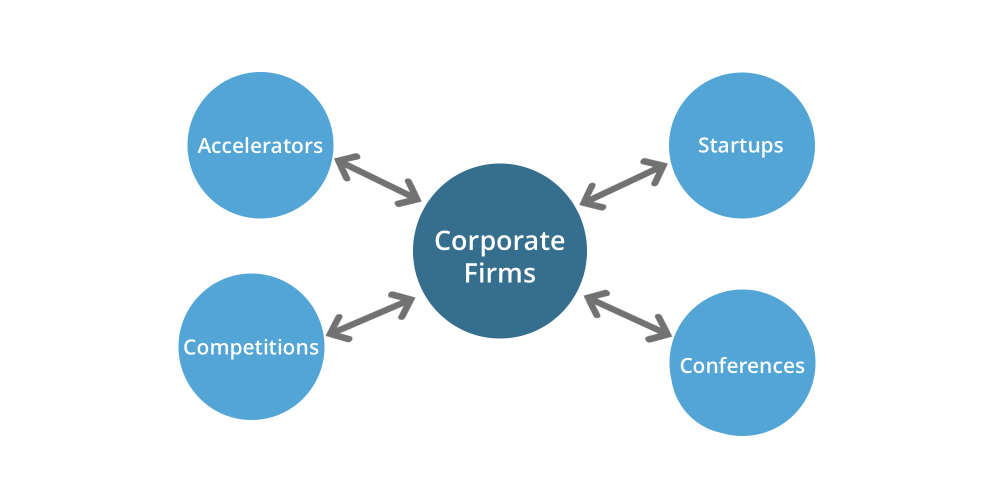

The Romanian startup ecosystem is taking up speed. The last 2 years saw much more activity compared with the 2010–2015 period. Together with accelerators and VC funds activity, an important aspect which contributed was the involvement of corporate companies (it also increased a lot compared to previous years).

We’re making a review of the main activities/contributions, while in the end we’ll take a shot at making a few predictions for the upcoming year, based on what we observed in the ecosystem and while working with some of these companies.

The list below is not exhaustive, for sure there were other activities that didn’t come to our attention, while other projects were not made public so we’ll not go into them.

So, what happened in 2018? One by one:

KPMG Romania partnered up with Spherik Accelerator to launch KPMG Startup Grow Pad, a program facilitating the connection with B2B startups in industries that KPMG has an edge and potential clients, with aim to develop commercial deals, invest or recommend the startup to KPMG Romania’s business connections.

Orange Fab program, in partnership with How to Web team, had its first demo day in September. At the event, it was announced the collaboration with 4 more startups, thus bringing the number of startups in the program to 10. The program was launched in September 2017, it has an on-going applications window, while it aims to reach commercial deals and integrations of startup products in the Orange ecosystem.”

Catalyst is Societe Generale European Business Services’s accelerator aiming to engage with startups and co-create solutions to business needs and challenges which SG deals with. During a 10-weeks program, companies selected worked on a specific business challenge, while SG will provide business guidance and mentors. The aim is to use the solutions in the SG group afterwards (no equity deal involved, just commercial partnership), thus the startup gaining a new client.

Societe Generale Group ran also an internal acceleration program, dedicated to employees and internal teams which have startup ideas. The best ideas get budget and support from the management. Romanian entities, European Business Services and BRD, in collaboration with TechHub Bucharest, had 3 such teams selected which have evolved into products that will be launched on the market in the first quarter of 2019.

Metro Systems (the information technology provider of Metro Group) is launched the Tech’n’Trade program, together with opening a new office in Cluj. Tech’n’Trade will support startups and young entrepreneurs with access to Metro’s Cash and Carry retail ecosystem, tech expertise, office space, mentoring and growth support.

Innovation Labs, the pre-acceleration program started in 2012, has already well established corporate partnerships which are supporting the whole network of events and workshops (5 cities in Romania): Orange, Carrefour, BRD, Continental, OMV Petrom, Microsoft, Adobe.

200 Seconds of Fame had also corporate companies supporting the competition, among them Orange, Nissan, Kaufland and BCR. The competition gathered 15 startups in the final taking place during the ICEE Fest conference.

Raiffeisen’s Elevator Lab is a corporate fintech partnership program in Central and Eastern Europe, created by Raiffeisen Bank International, aiming to find the best startups in the field of finance and to build long-term cooperation between them and the banks in the Raiffeisen Group. In Romania the competition was organised together with TechHub Bucharest and had 10 fintech startups in the final.

Startup Avalanche competition, part of Techsylvania conference, taking place in Cluj-Napoca, in June, had among corporate partners, Banca Transilvania, Betfair, Bosch, E.ON, Accenture and Metro, while it gathered 15 startups from Europe in the final.

Alpha Hub is a program initiated by Paddy Power Betfair in collaboration with Techsylvania and Risky Business, focusing on product-focused startups, development companies, individuals, and emerging teams. which can help overcome challenges in the gaming industry or focusing on the Responsible Gambling concept. The programs offers technical, product, and business consulting to help your company gain corporate collaboration and clients, while not taking any equity.

How to Web’s startup competition, Startup Spotlight, gathered a good range of corporate support. The competition was powered by KPMG Romania, followed by Bitdefender, Unicredit, Orange, Metro and Adobe as sponsors in the conference. The competition took place in November and it gathered 20 startups in the final, taking place during conference. Besides this, How to Web organized demonights events in Bucharest, Cluj, Timisoara and Iasi, having usually 5–7 startups pitching and corporate representatives, among the jury members.

Besides being very active in supporting startup-related organisations like Techsylvania, Cluj Hub, Spherik Accelerator, Techcelerator, Banca Transylvania launched BT Store, a platform for partnering startups which can provide complementary services to BT’s SMEs clients, thus strengthening the positioning as “entrepreneurs’ bank”. Besides this, BT has invested directly in startups, for example Ebriza and Pago.

Level-up is a new initiative launched in December by Nod Maker Space and Babele, with the support of Banca Transilvania and Bosch. It is the first accelerator dedicated to entrepreneurial makers in Romania. Participants will receive the support and the tools needed to develop an innovative product design, to validate their business model, to create a sustainable growth strategy for their business and to build a successful company. It has the first application deadline on January 31st.

Startarium incubator and online platform, created by Impact Hub Bucharest provides entrepreneurs and startups with the resources to learn about product management, business model, together with experts or mentors. The climax is Startarium Pitch Day, an event that offers prizes worth 100,000 Euro cash, sponsored by ING Bank.

Telekom joined the startup ecosystem space by supporting the program WeAccelerate (by WeLoveDigital) and sponsoring 10 startups with 10 000 euro each and assuring office space and business mentoring for 6 months.

In health domain, we saw a few actions as well, like Johnson & Johnson sponsoring the second edition of Hacking Health Hackathon and Philips being the main partner at SSIMA (International Summer School on Imaging with Medical Applications) applied on Artificial Intelligence.

Trends for the upcoming year

- Overall, the fintech sector was clearly most active and will continue to be in the upcoming year. The perceived pressure through which the banking and finance sector goes, drives banks to get involved as they want to use the opportunities and partner with startups taking advantage of the PSD2 regulations coming up in the EU. Fintech is followed by sectors like retail, telco and energy, while health will be catching up in the upcoming years, but slower due to the complex nature of the health ecosystem and regulations.

- Companies will try to make the process of innovation and collaboration with startups more effective. The last two years were not necessarily measured with strict, detailed KPIs but the following year we’ll see more measurement and thoughtfulness towards having concrete results/outcomes

- Economy/market turmoils in Romania will influence already-planned strategies. Some companies will be tempted to cut the innovation funds or marketing budgets destined to positioning in the startup ecosystem especially those that haven’t seen enough clear outcome from their previous activities. But those companies which understood that the innovation process takes time and money but in the end it brings the unique opportunity, will continue to invest even more.

- We’ll see more effectiveness also in the processes of collaboration with startups. Corporates understand that speed and flexibility is paramount in their collaboration so they will smooth out processes, going faster towards results and business deals. This will take considerable effort also from that part of the staff which don’t interact with startups and might be a challenge for the inner works of a big company.

- Word goes fast in the startup community, so startups’ applications to various programs will go mostly through recommendation of trusted peers. The community will know which programs work better, which are slow and not helpful enough, thus reputation among the ecosystem players will become extremely important.

- The space will still be very interesting for corporates; their activity and participation in conferences and events will grow, as it will be a source of connecting with ecosystem, finding new information and PR in the community.

- The mix between traditional accelerators or funds and corporates will grow even more. Corporates understand their limitation in understanding startups and will continue to look to players who can intermediate/facilitate this collaboration process.

- Big companies will continue to work with local players for creating programs or competitions, which can be better promoted and formed by the existing conferences, accelerators. As well experts or upper management staff will be invited as mentors to various competitions and programs thus being a good way to see what is happening in the startup ecosystem.

- The funds and accelerators will receive investment from corporates or from upper management, so they will become limited partners in those venture capital structures. It will be a way for corporates to spot early startups to collaborate and benefit later on.

Although we saw action, overall the ecosystem needs more of these actions. Corporate companies can contribute, but it’s not up to them to build the ecosystem. We cannot have a healthy growing ecosystem, without all the types of actors being active. This includes accelerators and VC funds working with corporates, while universities being more involved in the entrepreneurial education and supporting startups springing up from academia environment.

The startup ecosystem in Romania is shaping up compared with the last 5 years thanks also multinational corporations. I believe they understood that on a global market which has less and less borders, the only real way of bringing added value to their services and products is by innovating.

If you have other relevant information, feel free to comment! Any other observations and predictions are very welcomed!