This article presents insights based on our scouting and mapping processes, through which we gather various news, updates, events, opportunities and many other topics of interest related to the startup ecosystem.

As part of Startup Ecosystem Radar, we curate and condense this valuable information into a digestible format and offer it as a free monthly newsletter to our partners and clients. Our goal is to provide insights about the ecosystem, empowering informed business decisions and facilitating connections with relevant stakeholders. Don’t miss out on the latest updates – subscribe to our newsletter today!

Based on public announcements, during the first half of 2023, we managed to track 31 investment rounds in Romanian startups and 6 in foreign startups that have at least one Romanian founder (residing abroad).

The investment amount for this period reached approximately €69.2M across 30 rounds (and one round undisclosed) in domestic startups, while foreign startups with Romanian founders secured ~$58.1M (~€51.7M) across 6 investment rounds.

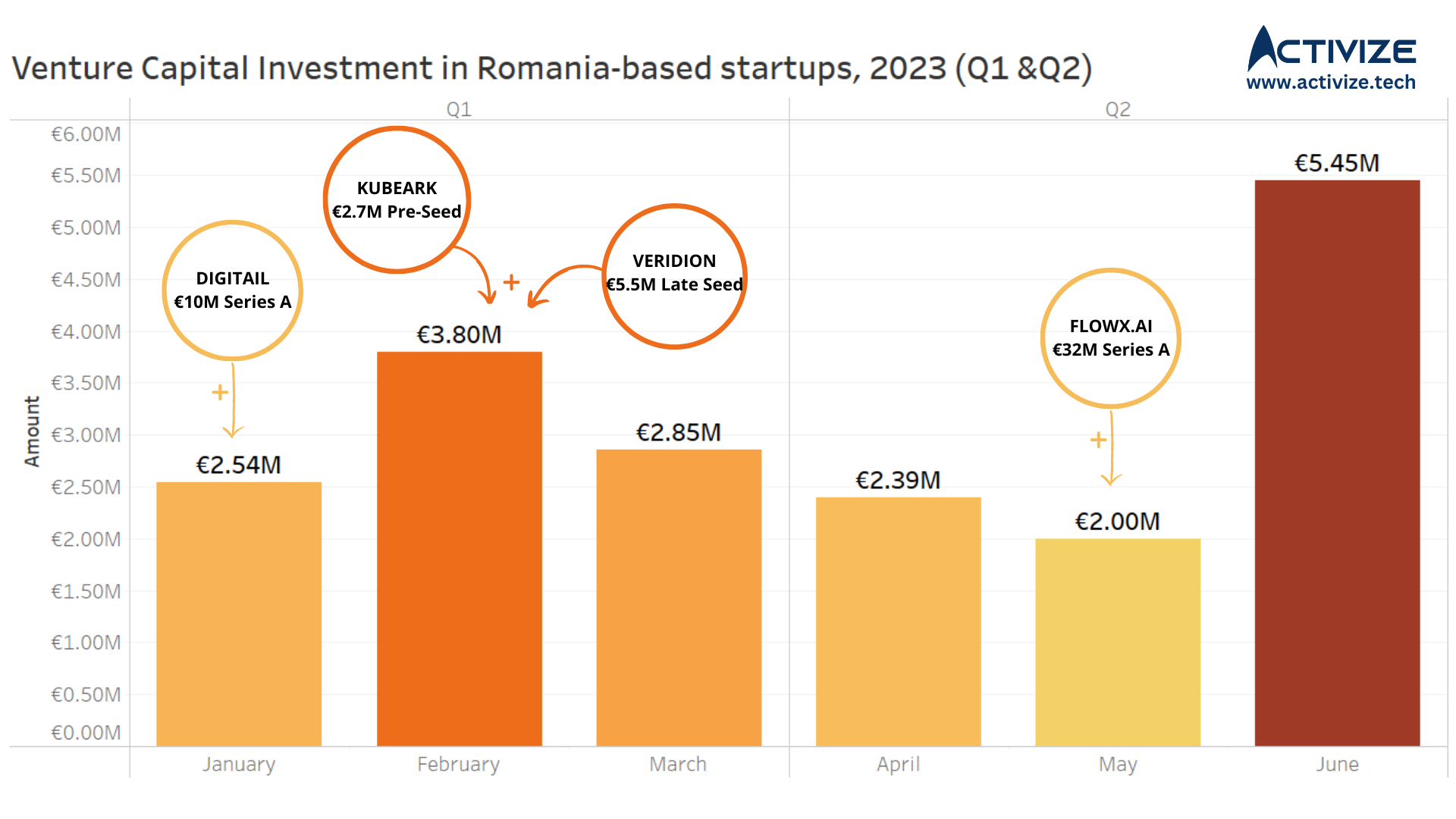

It is important to note that the above analysis is highly impacted by FlowX.AI‘s significant ~€32M ($35M) Series A investment. In order to be able to make more realistic conclusions, we decided to show it separately together with the others two big rounds (Digitail and Veridion) as most of the capital in these 3 rounds was not originating from Romania. Also to mention that Kubeark’s $2.8M round was entirely foreign funded.

Furthermore, in the following chart, we have mentioned separately the biggest investment rounds made this year in order to better observe the monthly distribution of the invested capital

Over the past two years, the startup ecosystem in Romania went through some notable developments in terms of the investment activity. Analyzing the first half of 2022 (you can check out our article from last year regarding this topic) and 2023 reveals a few trends related to startup investments.

In the initial six months of 2022, €64.5M was invested in Romanian startups across 36 investment rounds.

However, the first half of 2023 witnessed a ~42% decrease in the total investment volume. Romanian startups managed to raise €37.1M distributed across 29 investment rounds (we didn’t count FlowX.AI’s ~€32M Series A investment round). This indicates that the level of interest from investors is still there, albeit slightly reduced compared to the previous year.

The data can show us an important shift in the investment landscape, with investors adopting a more selective approach. The overall investment amount experienced a significant decline, there is an amount of local capital flowing into good startups.

Regarding distribution of the investments received by the Romanian startups, we can group them by the following way:

- €725K in 6 rounds up to €200K (probably others investments were made at this stage, but these were not announced publicly)

- €6.17M in 11 rounds €200K to €1M

- €15.7M in 10 rounds €1M to €3M

- €15.5M in 2 rounds higher than €3M (Digitail and Veridion)

- FlowX.AI’s ~€32M ($35M) round

Some of the highest and most important deals were the following:

- The Romanian IT startup FlowX.AI obtained a venture capital financing of ~€32M ($35M), in an investment round led by the London fund Dawn Capital (link).

- Digitail, a veterinary platform founded by Romanians, announced the closure of a $11M (~€10M) Series A funding round led by Atomico, joined by previous investors byFounders, Gradient, and Partech (link).

- Veridion has secured a $6M (~€5.5M) investment to expand its sales and marketing intelligence platform in the US market. The funding round was led by LAUNCHub Ventures, OTB Ventures, Underline Ventures, joined by previous investors Gapminder and Day One Capital, and will be used to accelerate Veridion’s growth in the US, as well as to further develop its product (link).

- Kubeark, a hyper-scaling platform, has attracted $2.8M (~€2.6M) in funding in a pre-seed round. The investment round was led by Credo Ventures, with participation from Seedcamp, LAUNCHub Ventures, 500 Emerging Europe and others (link).

- Catalyst Romania Fund II, a leading venture capital fund in Southeast Europe, has invested €2M to support the scaling efforts of the ESX platform (link).

In order to have access to the full list of investments as they appear, subscribe to Startup Ecosystem Radar.

Funding for foreign startups with Romanian founders

Regarding the funding raised by startups which have at least one Romanian co-founder, this totals ~$58.1M in 6 deals. This amount has notably decreased compared to the same period in 2022, this being ~€500.3M.

The biggest investments were the following:

- Hackajob, the London-based startup co-founded by Romanian Răzvan Creangă, received a $25M Series B investment to grow the platform that helps find technical employees (link).

- Dexory, formerly known as BotsAndUS, a startup founded by three Romanians in the UK, has successfully secured a $19M investment in a Series A funding round led by Atomico (link).

- Finverity, a trade and supply chain startup co-founded by Alex Fenechiu in the UK, has announced a $5M investment round from venture capital funds Outward VC, Acrobator Ventures, s16vc, B&Y Venture Partners and other private investors (link).

In order to have access in real time to this kind of information, join Startup Ecosystem Radar.

Closing

It is worth noting that these statistics provide just a snapshot of the first half of the year. The full-year picture may reveal further fluctuations and trends that could unveil some facts regarding startup venture capital funding in Romania.

As the startup ecosystem continues to evolve and respond to various economic and market factors, it will be interesting to track future investment patterns and see how the growth and innovation of Romanian startups will be influenced.

See you at the end of 2023, when we will be back with a comprehensive overview of venture capital funding in Romanian startups for the entire year. Until then, stay tuned for further insights and developments regarding the startup ecosystem by subscribing to our newsletters down below!