Introduction

As we recently said farewell to 2023, it’s time for us to make a recap of what happened last year in the Romanian startup ecosystem in terms of venture capital investments. In this overview, we’ll present significant insights and highlights, offering a comparative analysis of the capital inflows against previous years.

Additionally, we’ll spotlight some of the most noteworthy funding rounds, providing a comprehensive recap of the important moments that defined the landscape of venture capital investments in the Romanian startup scene throughout the past year.

This article is based on our scouting and mapping processes, through which we gather various news, updates, events, opportunities and many other topics of interest related to the startup ecosystem. As part of Startup Ecosystem Radar, we curate and condense this valuable information into a digestible format and offer it as a free monthly newsletter. If you would like to get these reports, subscribe by using the form at the end of this article.

If you are interested in finding out more about the state of Romanian startup investments, you can explore the 2022 edition here and also we have made a wrap-up in which we discuss the first half of 2023 from startup investments perspective.

What has happened at the European level?

To understand the local startup scene, it’s important to also reflect on the existing macro-level trends across Europe.

Each year, the venture capital firm Atomico publishes a report called The State of European Tech, which includes a comprehensive analysis of investment trends. In the 2023 edition, the report reveals a notable shift in the European tech landscape, projecting a significant decrease in total capital invested in tech startups to $45 billion – down by 55% from 2021, when the investment volume exceeded $100 billion for the first time.

This shift was caused by a multitude of factors, such as inflation, higher interest rates, economic uncertainty, and geopolitical events. All of these continue to impact VC funding for startups in Europe. According to Atomico, the continent was on track to raise only $45 billion in 2023, roughly half of the $82 billion invested in 2022.

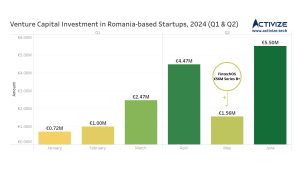

Funding for Romania-based startups during 2023

Monitoring the public announcements, we found out that during 2023 there were 54 investment rounds made in Romanian startups (2 of these were undisclosed).

The amount invested in startups reached approximately ~€66.85M across 50 rounds.

It’s important to note that the figures do not include DRUID’s ~€27.4M ($30M) round and FlowX.AI’s ~€32M ($35M) round. The decision to exclude these amounts is driven by the desire to present a more realistic situation of the general funding trends in Romania, as these particular investment sums are considered outliers within the context of the overall local funding landscape and their investors are from outside Romania.

Taking this into consideration, the following chart illustrates the quarterly comparison of venture capital investments in Romanian startups for the years 2022 and 2023. We have also highlighted the largest investment rounds undertaken in each of these years for a clearer observation of the quarterly distribution of the invested capital.

Examining the quarterly breakdown of investment figures for 2023, we see a slightly distinct pattern as in 2022. The first and fourth quarters stood out with €27.4M and €25.6M, while the third quarter, recording €3.04M, marked a notable dip, indicating the calmer period of summer and delayed investment process.

Starting from 2018, for 4 years there was a continuous upward trend, with investment amounts steadily increasing each year and the number of deals gradually rising. In 2021, Romanian startups experienced a milestone year: nearly 100 deals were made, totaling €85.56M. But after this successful year, unforeseen events unfolded, influencing the funding environment for startups. The evolving global landscape introduced challenges and shifts, which contributed to a general decrease in the total amount invested by venture capitals, a trend that started from the year 2022 onward.

In 2023, the total amount invested in Romanian startups showed a decrease of nearly ~16% compared to the preceding year, 2022. Furthermore, when contrasted with the robust funding of 2021, there was a more substantial decline of approximately ~22%.

The above chart highlights an existing situation on the size of the rounds in 2023. Specifically, the most popular deal types are situated between €200K and €1 million, indicating a strong emphasis on small-sized funding rounds, where angel investors networks are active (to name a few, Techangels, Growceanu, Transylvania Angels Network, Bravva and WIT Angels Club).

It is important to consider that in 2023 we had few funds which invested very little or at all as they were at the end of the active investing period and their focus was on raising the next funds, which will probably be launched in 2024 – this leading to a growth again in funding rounds.

While T.A.N. members invested more in 2023 than in 2022 it was still a year filled with trepidation. This was due to investors being wary of the known macroeconomic issues and problems (inflation, interest rates rising, wars, etc.), as well as the microeconomic circumstances for their families and firms. Expecting 2024 to be a similar year, or even more worrying, due to the ongoing and unresolved global uncertainties.

Emmett King, co-founder of Transylvania Angels Network

Considering the deal size, we have the following:

- €1.37M in 13 rounds up to €200K

- €13.47M in 23 rounds €200K to €1M

- €18.31M in 10 rounds €1M to €3M

- €33.7M in 4 rounds higher than €3M

- FlowX.AI’s ~€32M ($35M) round

- DRUID’s ~€27.4M ($30M) round

- 2 undisclosed rounds

Overall, for us 2023 was a low point in terms of investor interest in the early stage asset class. Similar or better deals than those on the table a year prior were left untouched by angels who preferred to pay attention elsewhere in their portfolio. Future moonicorns will probably come from all areas of the tech sector, with AI technology continuing to have an increasingly important role to play in everything that is being created

Ciprian Man, co-founder of Growceanu

Some of the highest and most important deals from the second half of 2023 were the following:

- Romanian AI startup Druid announced it has raised $30M in a series B round of funding led by TQ Ventures (link).

- Bobnet, a startup that develops hardware and software solutions for the automation of the retail industry, has obtained financing of €15M from the American investment fund NCH Capital (link).

- Bright Spaces,a startup for the real estate industry, has launched a fundraising campaign on SeedBlink, to reach its goal of ~€2M in a new round. €1.85M have already been raised from VC funds that have supported the startup in the past, but also from new partners (link).

- Nooka Space has secured a €2M investment round to support the ongoing global expansion (link).

If you are curious which were the most important deals from the first half of 2023, you can read them in our 6 month overview, here.

From an investment perspective, 2023 was peculiar, especially compared to the past 2-3 years. Due diligence became more rigorous and that made for less opportunities. But the ones that we had were definitely more qualitative and it seems that founders did listen to the advice that everyone was giving at the beginning of last year – “traction and sustainability over growth”. This leads me to think that 2024 will become more balanced – the start-ups are more mature and investors will have to deploy, given their activity in the past two years.”

Valentin Filip, managing partner at Fortech Investments

Funding for foreign startups with Romanian founders

Regarding the funding raised by startups which have at least one Romanian co-founder, this totals ~$706.07M in 14 deals and 1 undisclosed one, seeing a growth of approximately 35.2% compared to 2022 when the sum was ~$521.96M in 13 deals.

The biggest investment rounds were the following:

- Databricks, an AI and data analytics startup with two Romanian founders in its team (Ion Stoica & Matei Zaharia), raised a series I investment worth over $500M led by T. Rowe Price (link).

- Tractable, a London-based AI startup that uses computer vision to assess the condition of cars and homes, has announced a $65M series E investment led by SoftBank Vision Fund 2. The company is cofounded by the Romanian Răzvan Ranca (link).

- MaintainX, a startup founded by the Romanian Chris Țurlică, received a $50M series C investment for the product that offers software for industrial maintenance (link).

Closing and predictions for 2024

Keeping an eye on the venture capital ecosystem, we’re not surprised by these results.

The past year (2023) stood at the intersection of two forces: contraction in funding due to macroeconomic changes (leading to investors being more selective or focusing on supporting existing portfolio companies) and decreases in funding due to “gap year” for some funds that closed their active investing period.

For 2024, we expect the launch of a few new funds, either as the second fund in greater size and new funds based on angel investors activity. This is on the plus side.

On the other side, the macro-economy will continue its downtrend which will not be encouraging for private investments (angel investors will continue to be cautious and play safer, while venture funds will be focused in selection on scalability potential of the startups).

We see startups that are willing to be paying more attention to innovation public grants to focus their early-stage product funding.

The number of programs for startups will continue to rise (new ones being launched) as these programs are contributing a lot to investment-readiness and connections with investors.

While, the European funds (mostly from central Europe), will continue to be active in the Romanian ecosystem, not as first investors, but in co-investing roles together with local funds.