This article is based on our scouting and mapping processes, through which we gather various news, updates, events, opportunities and many other topics of interest related to the startup ecosystem.

Part of the Startup Ecosystem Radar, we prepare this information in a digestible form and deliver it to our partners and clients on a weekly basis, with the aim to inform them about the ecosystem and help them make business decisions.

Relying on the public announcements, in the first 6 months of 2022, we have tracked 36 rounds of investment made in Romanian startups and 12 in foreign startups which have at least one Romanian founder (living abroad).

The volume of these investments for the aforementioned period was ~€64.5M in 36 rounds in startups that are based in the country and ~$500.3M in 10 rounds (2 other rounds were undisclosed) in foreign startups with Romanian founders.

Comparing this data with the one from last year, we can see that there has been a slight decrease both in the number of rounds and in the amount invested. When in the first part of 2021, there was €82.2M raised in 50 rounds by the Romanian startups, this year the invested amount went down by almost 22%. This can be attributed to the fact that inflation is getting higher by the day, a recession is looming around the corner and let’s not forget about the war in Ukraine affecting the overall growth in Eastern Europe and making investors more cautious. So considering these facts, people in general are not so keen on doing risky investments.

Going further and analyzing the distribution of the investments received by the Romanian startups, we can group them by the following way:

- €300K in 3 rounds up to €200K (probably many others investments were made at this stage, but these were not announced publicly)

- €8.2M in 17 rounds €200K to €1M

- €18.8M in 10 rounds €1M to €3M

- €37.2M in 6 rounds higher than €3M

Some of the highest and most important deals were the following:

- TeleportHQ, an innovative Romanian startup which is building the next generation low-code collaboration platform for front-end development, has raised $2.5M in seed funding from One Capital (link).

- Machinations.io, a Romanian browser-based platform to design and predict game economies & systems for premium, free2play, and play2earn games, raised $3.3M in Series A funding led by Hiro Capital and supported by Acequia Capital, Venrex Investment Management and GapMinder (link).

- Cyscale, Romanian software developer of data protection solutions and applications in the cloud, has obtained a €3M seed funding led by Notion Capital, with participation from Seedcamp, GapMinder and others (link).

- Bware Labs, a Romanian startup that builds a decentralized blockchain platform that helps businesses integrate multiple blockchains at once, eliminating infrastructure costs, has received a $6M Series A investment from a group of venture capital firms (link).

- DRUID, the end-to-end platform for building AI-driven conversational business applications, announced that it has raised a fresh round of funding worth $15M led by Karma Ventures and joined by GapMinder (link).

In order to have access to the full list of investments as they appear, subscribe to Startup Ecosystem Radar.

Funding for foreign startups with Romanian founders

Regarding the funding raised by startups which have at least one Romanian co-founder, this totals ~$500.3M in 10 deals and 2 other ones that were undisclosed. This amount is more than double than the one from the same period in 2021, this being ~€242.8M.

The biggest investments were the following:

- Aggero, a startup founded by a team of Romanians, but based in London, received an investment of $2M led by Launchub Ventures and supported by Gapminder, SCM Advisors, Klaas Kersting and Phil Mohr. Aggero is developing a platform for monetizing and analyzing video streams in the gaming and esports area (link).

- Fullview, a Danish startup co-founded by Dorin Tarau and which enables SaaS companies to deliver fast technical customer support, has raised $7.5M in seed funding led by Lightspeed Venture Partners (link).

- The German startup Avi Medical, co-founded by the Romanian Vlad Lata, received an investment of €50M Series B for the development of its digital family medicine platform. The round was led by Balderton Capital and joined by Vorwerk Ventures, Heal Capital and others (link).

- Branch, a USA-based startup founded by Romanian Madalina Seghete and which helps companies drive seamless mobile experiences through its linking infrastructure, has received a series F investment worth $300M led by New Enterprise Associates (link).

In order to have access in real time to this kind of information, join Startup Ecosystem Radar.

Closing

The COVID-19 pandemic may seem to be over, but we are still living uncertain days, which can and will influence a way or another the financial markets. Even so, we see that startups are trying their best to attract funding, to develop their products and services, and to stay above the water.

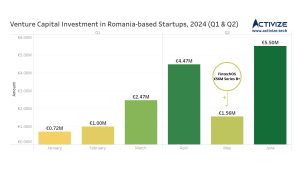

Looking at this years’ quarterly trend, we see that the new year started at a slow pace, but the second quarter finished in a nice way, the investments made in Q2 (~€42M) are almost double the ones from Q1 (~€22M).

Aside from these facts, last year’s structure was almost the same, as the quarters passed, the amounts invested in Romanian startups followed an increasing trend. This can show that if the flow remains the same as it is now, at the end of 2022, we will calculate a relatively high total volume of investments.