Introduction

While doing our scouting and mapping processes, we gather various news, updates, events, opportunities and many other topics of interest related to the startup ecosystem.

Part of the Startup Ecosystem Radar, we prepare this information in a digestible form and deliver it to our partners and clients on a weekly basis, with the aim to inform them about the ecosystem and help them make business decisions.

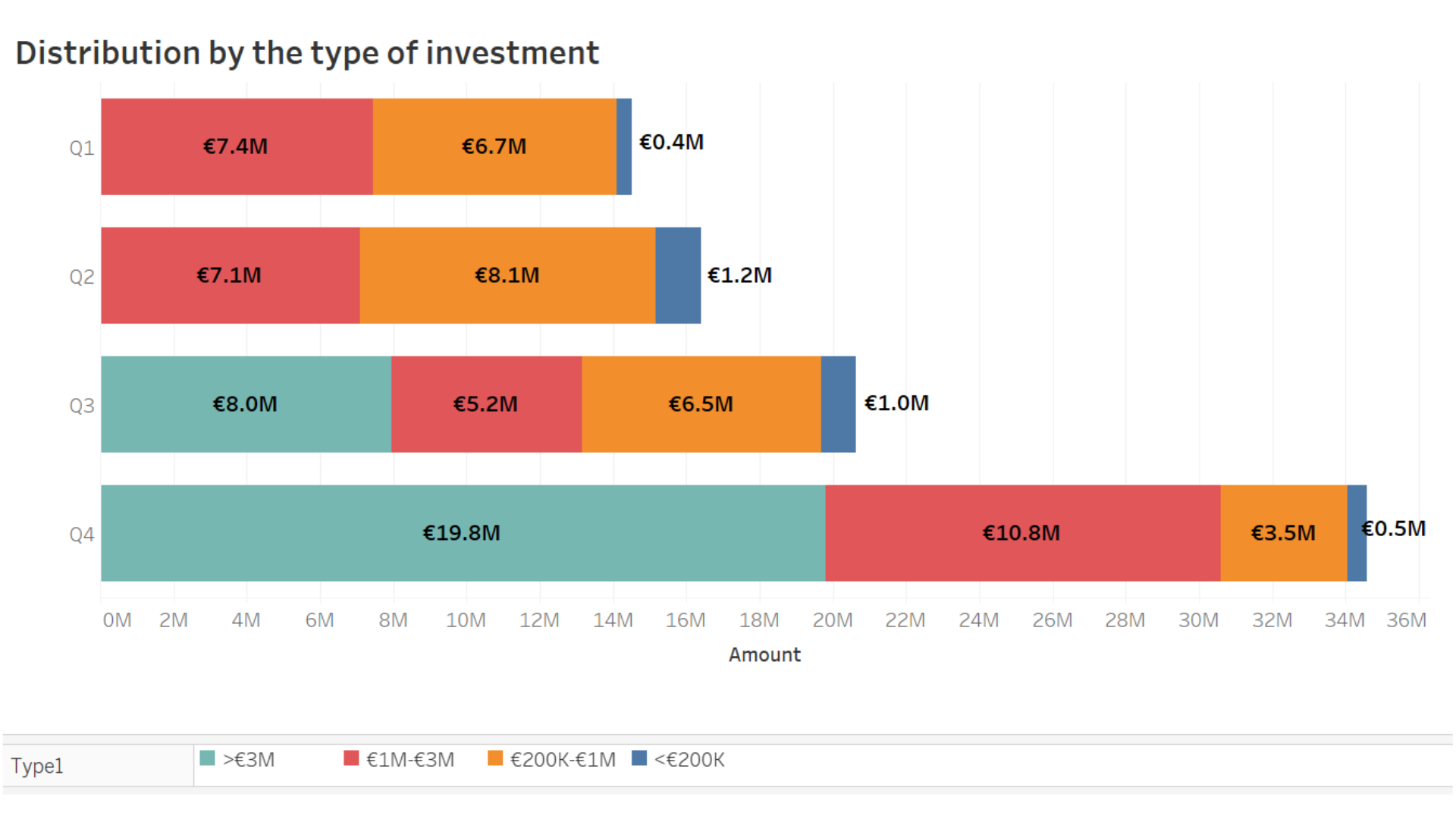

While we made an overview of the funding for Q1 and Q2 of this year here, see below a summary for that period: ~€82.2M in 50 deals, divided by the following way:

- €1.5M in 12 rounds up to €200K

- €14.1M in 28 rounds €200K to €1M

- €16.4M in 9 rounds €1M to €3M

- $60M in FintechOS

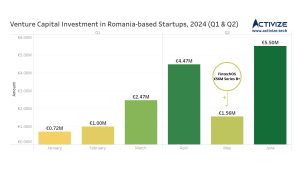

Through July to December 2021 (Q3 and Q4), the startups based in Romania have attracted ~€54.7M in 43 deals, divided by the following way:

- €1.5M in 10 rounds up to €200K

- €8.4M in 19 rounds €200K to €1M

- €17M in 10 rounds €1M to €3M

- €27.8M in 4 rounds higher than €3M

Let’s see below the distribution during months as a way to see the most activizing time for closing a round

As the visualisation shows, the year started quite well, but the biggest amount of total investment was received in the last part of 2021, the fourth quarter leading the year to be of a great success to the Romanian startups. We treated UiPath’s Series F and FintechOS’s Series B as outliers of the landscape.

As last year everything was affected by COVID-19 pandemic, this year the industry took it as the new normal and, although facing uncertainty, didn’t create major concerns in venture capital while the growth still continued enthusiastically.

Similar with last year, growth trends were in general supported by a few factors:

- crowdfunding campaigns (became established and well known fundraising mechanism)

- angel networks activity (new members joining with interest for making investments)

- continued activity of the venture funds (which sustained the trend)

- foreign venture capital funds looking to (co)invest in Romanian startups even at pre-seed stage

- capital existing in the general market with interest to be placed in the tech startups and not only in the traditional stock market

- co-investments (which helped startups close bigger rounds and faster)

- And of course better prepared startups (quality of pitching and business increased)

This being said, we conclude that in 2021 there were 93 investment deals concluded and announced (probably there are 10% to 20% more, but not made public), The total value is at ~€85.6M (without the ones received by FintechOS and UiPath). If we count the Series B financing received by FintechOS, the total amount raised by Romanian startups will be ~€138.6M.

Looking through the whole year, some of the highest investments in 2021 were the following:

- FintechOS, the global technology provider for banks, insurers and other financial services companies, has raised $60M in Series B funding. The round was led by Draper Esprit (link).

- The crowdfunding platform SeedBlink ended a Series A financing round worth €3M, of which €1.1M was funded through its own crowdfunding platform, double its initial target. This investment campaign was the largest financing carried out through the platform SeedBlink (link).

- Druid, a startup specialized in developing intelligent virtual assistants (chatbots) for Enterprise organizations, has raised $2.5M through a Series A financing round led by GapMinder VC with an investment of $2.2M, and completed by Early Game Ventures and private investors (link).

- Code of Talent concluded a round of Series A financing worth €1.7M, led by Catalyst Romania as a lead-investor, with the participation of current investors, RocaX and SeedBlink (link).

- Romanian startup FLOWX.AI, an enterprise platform that enables banks and financial institutions with complex IT infrastructures to build fast modern digital experiences unbounded from the limitations of their legacy systems, has raised $8.5M, round led by PortfoLion and joined by Day One Capital and SeedBlink (link).

- Romanian deep tech startup, Humans, announced that it raised $9M financing through the private sale of cryptocurrency. Among the main investors are the entrepreneur Răzvan Munteanu, one of the most active investors in the blockchain area and Elrond Research, the investment arm of the most respected blockchain companies in the world (link).

We would also like to mention .lumen’s grant (not included in the numbers as it was an EIC grant), who has been selected by the EU for more than €9M in funding under the European Innovation Council Accelerator (link).

In order to have access to the full list of investments as they appear, join Startup Ecosystem Radar.

Funding for foreign startups with Romanian founders

In the second part of 2021 the startups which have at least one Romanian cofounder living abroad raised a total of ~$154.6M in venture capital

- The American company Databricks, which has two Romanian IT specialists among its founders, obtained a financing of $1B, with the participation of Google Ventures, Amazon, and Microsoft (link).

- Proportunity, a startup founded by two Romanians, Vadim Toader and Ștefan Boronea, in the UK, and which helps people get a house faster, has received $150M in funding. The investment round was led by VentureFriends, Kibo Ventures, to which were added the existing investors, Anthemis, Entrepreneur First, as well as Amro Partners (link).

- London-based startup Aurelia, which allows businesses to integrate multiple bank accounts and financial tools into a single application, has received a $3M investment led by Blossom Capital. The startup was founded by the Romanian Sebastian Trif (link).

Comparison 2018 to 2021

As we keep track on funding rounds since a a few years now, you can see below how we stand: continuous growth with 2021 being more than double the previous year (which also sustained the pandemic shock).

Conclusion

There is enthusiasm and interest in the venture capital market and there are no signs that this will stop in the next year.

At least 5 new Romanian venture capital funds, angel funds or angel networks will be launched in the upcoming year, while the foreign funds will be more active here looking to expand their presence.

It has never been a better moment for (good) tech startups to raise private venture funding.

At Activize, we will continue our commitment to keep track and inform about the startup ecosystem (diving more in other countries in Eastern Europe) and, as well, to support startups in fundraising, through connections with investors, pitch deck feedback and advice on fundraising strategy.